If you’re concerned about your mortgage closing costs being too high, then I can’t blame you for googling “how do mortgage loan officers make money?”

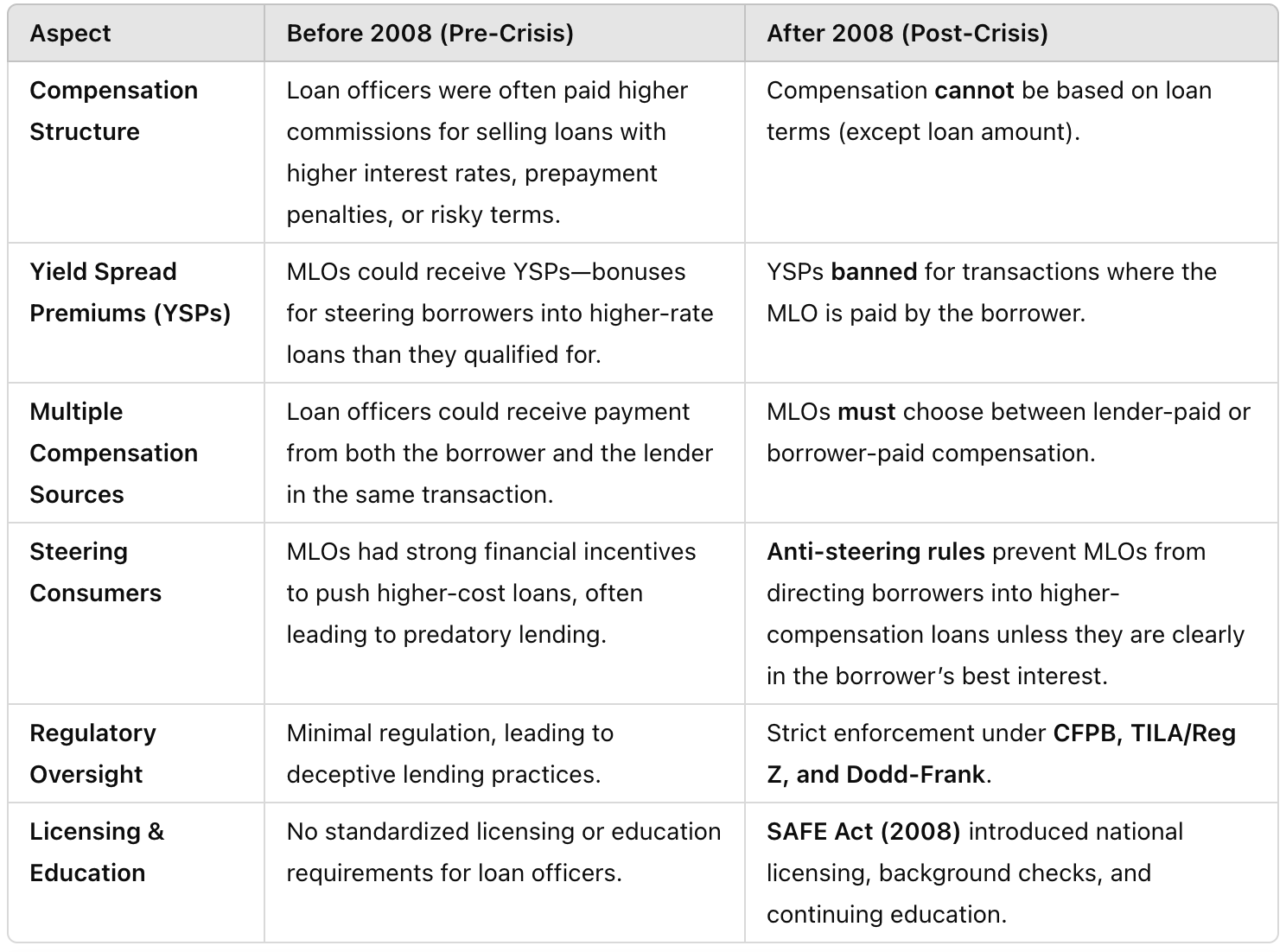

The good news is that loan officer (or loan originator) compensation is highly regulated these days. It doesn’t fluctuate as much as it used to, back in the days before the housing market collapse.

The bad news is that mortgage companies build their profits (including the loan officer compensation) into the interest rates they sell you, and there is no breakdown that will tell you exactly what it is.

Only shopping around will reveal differences. Feel free to email me your scenario at [email protected], and I’ll provide you with a detailed mortgage quote within hours.

Mortgage loan officer (MLO) pay: Before and After 2008

The Dodd-Frank Act (2010) and the CFPB’s Regulation Z (2011) were major turning points. They both worked to remove financial incentives that encourage predatory lending, and also forced more transparency in mortgage loan origination.

How much do mortgage loan officers actually get paid?

Specific to mortgage loan officer pay, the following generally applies these days:

- If you’re likely to walk in and become a customer, then they’ll make a small commission only, on top of a salary or base pay. Think local banks and credit unions. Or your current mortgage loan servicer. It doesn’t mean it will cost you less, it just means that their mortgage loan officers are paid less, and trained less. The job is a typical 9 to 5.

- Most everyone else in the industry works for commission only, or a mix of a small base pay + commission. If the deal doesn’t close, they don’t get paid. They’re generally available on the weekends, and work closely with real estate agents. The pay can be anywhere from 0.5% to 3% of your loan amount.

The more skilled the mortgage loan officer, the higher the pay. But who the mortgage loan officer chooses to work for will ultimately determine the cost of your mortgage interest rate – not how much they personally get paid.

What is mortgage loan officer compensation NOT based on?

Mortgage regulation has removed a lot of the previous incentives that were hurting borrowers. However, there are still some indirect ways of steering clients towards loan products or interest rates that are not in a borrower’s best interest.

Here is what you should keep an eye out for:

PROBLEM: Mortgage loan officers have an interest in you paying discount points for a lower rate. This is a common strategy with overpriced mortgage companies, because they get penalized if you refinance your mortgage loan again too soon. It also allows them to “brag” about the low interest rates they’re offering.

SOLUTION: Stop looking at the savings over the life of the loan. How many people do you know or have you heard of that actually keep their original mortgage for that long?? Statistically speaking, most people sell or refinance between years 3 to 7.

Most people should only pay the discount points that allow them to break even in 2 to 3 years.

A lot can happen in 5 years, and if history give us any clues, you’ll likely have a refinance opportunity, experience a divorce, or need to pay off consumer debt by tapping into you home equity.

PROBLEM: Mortgage lenders can offer competitive pricing on Conventional loan products, but horrible bloated interest rates on government loans like FHA, VA and USDA.

This is because borrowers using government backed mortgage loans tend to be first time homebuyers, or have lower credit scores. They won’t be as savvy or vocal about the interest rates they’re getting, which makes them an easy target for overpriced mortgage loans. The mortgage loan officer doesn’t make more, but the mortgage company makes more profit.

SOLUTION: Shop around, or use a mortgage broker that will shop around for you. Don’t rely on a single mortgage lender’s rate offering, just because your colleague with an 800 credit score and a large down payment had a good experience.

If the cost sounds high, shop around.

What mortgage company did you apply with?

The mortgage rate you’ll be offered, as well as the cost associated with it (origination charges/discount points/lender fees in general) can vary wildly, depending on where you get your mortgage from.

If you ask your mortgage loan officer why you’re being offered a certain rate, you’ll usually be told that it depends on:

- market conditions

- your credit score

- your down payment amount

- the type of loan you’re doing (Conventional, FHA, VA, USDA or Jumbo)

- the type of property you’re purchasing (condos and multi units are higher risk than single family homes)

- whether you intend to occupy as a primary residence, second/vacation home or investment property etc

All of these things are accurate. But here is what you’ll never be told, and that directly affects your mortgage rate and costs associated with it:

- a mortgage company’s typical overhead costs – the more layers of management they have, the higher those costs are

- how much that company spends on advertising (think billboard adds on I-15, paid adds on Google, or purchasing your information from various scammy websites that pretend to connect you to lenders your can shop)

- whether they share advertising costs with real estate agents – Zillow is an example of spending thousands of dollars each month to prey on inexperienced first time homebuyers (less likely to shop around)

Mortgage Brokers vs Mortgage Lenders/Bankers

You options are generally one of the two: you can get your mortgage by applying directly with a lender, or you can have a mortgage broker shop multiple lenders for you. You can also shop around multiple mortgage brokers, since they may work with different lenders, and have different compensation plans.

Mortgage lenders

Mortgage lenders underwrite and fund mortgage loans. From there, there are many avenues to make money, such as by either selling or keeping servicing rights (the collection of the actual mortgage payments). Or selling the mortgage loans at a premium to the secondary market (Fannie Mae/Freddie Mac/Ginnie Mae).

Types of Mortgage Lenders/Bankers

- Retail Lenders have their own mortgage loan officers and origination departments . These are generally the companies that already service your mortgage loan (or other types of credit), and send you endlessly annoying emails asking you to purchase or refinance with them. They will rarely give you the best deal, because they’re counting on you using them out of comfort and familiarity. And because of their aggressive direct marketing.

- Some Retail Lenders have both a retail and a wholesale channel, and they generally operate under two different business names. They also service most if not all their mortgage loans. The customers already in their data base, or obtained through their marketing channels are given higher cost interest rates. New customers obtained via the mortgage broker channel are given lower cost interest rates (even with the mortgage broker compensation included), as a cost of “client acquisition”. They know that once you become a client, your are likely to use them for future mortgage transactions on their retail side.

- Wholesale Lenders work exclusively with mortgage brokers. They stay cost effective by allowing mortgage brokers to act as their sales, marketing and loan processing departments. No payroll costs or benefits either, because mortgage brokers are independent contractors.

Mortgage Brokers

Utah Mortgage Resource is a local Utah mortgage broker.

I won’t underwrite or fund your mortgage loan. I put together your loan application, verify your documentation and assets, counsel you in regards to available loan options, and pair you with a wholesale lender that will fit your loan scenario. My main job is to get your loan closed, and advocate for you in cases of underwriting discretion.

Overall, the rates of denial are so much lower with mortgage brokers because :

- We have access to a variety of different mortgage lenders that may follow different guidelines

- If your loan doesn’t close, we don’t get paid.

Compensation differences between mortgage lenders and mortgage brokers

When the real estate market crashed in 2007-2008, mortgage brokers were demonized. But mortgage brokers were never the ones making the rules or approving the loans. Lenders were. And lenders were enabled by the secondary market not exercising proper supervision, and not having proper safeguards in place.

The result?

Mortgage Brokers are now highly regulated. Mortgage Lenders still have loopholes for abuse.

One such loophole is the ability to hide exactly how much compensation is received from a loan.

Mortgage broker compensation is limited to a maximum 3%, with most local brokerages in Utah hovering around the 2% mark. This can be built in the interest rate (lender paid compensation – most common), or it can be charged directly to the borrower as an origination cost (borrower paid compensation). Never both.

- If the compensation is built into the interest rate, it will be disclosed on the Closing Disclosure as a fee paid on your behalf by another party (the wholesale lender that underwrote and funds your loan).

- If you are being charged an origination, it will be listed on the Loan Estimate you receive with your initial disclosure package.

Mortgage Lender compensation can be built into the interest rate without any need for disclosure. Therefore, there is no cap on how much a mortgage lender can make – it could be as high as 5% or more. They can also charge an origination cost on top of it, just to throw you off, and make it look like they’re only charging “half a point”.

The Qualified Mortgage Rule (enacted January 2014) mandates that a borrower cannot be charged more than 3% in points/origination fees. Unlike mortgage brokers, any profit a mortgage lender makes on a specific interest rate is not disclosed, and therefore not considered in the 3% calculation. Oops.

Questions to ask when shopping for a mortgage loan

- Is there an application fee? (even if refundable at closing, this is a huge red flag)

- Will there be an origination charge, or is your compensation included in the interest rate?

- Can I get a detailed quote without a credit pull? (the answer should always be yes!)

- Can I get a few different rate options to choose from?

If you dread the thought of multiple credit pulls, know that a credit pull is not a requirement for receiving a mortgage quote. Any mortgage loan officer can run the numbers if they know some of the basics: purchase price, type of property and occupancy, downpayment amount, approximate credit score and loan program.

If a mortgage loan officer insists on a credit pull and/or additional documentation, move on. It’s just a sales tactic to get you invested in working with them.

How do you choose a good mortgage loan originator?

There are plenty of honest people in the industry. Not all businesses turn greedy when in a position to get away with it. But you have to make sure they have an incentive to stay honest. Shop around. Ask questions.

Give your business only to the ones that earn it and deserve it. Look past incentives, don’t worry about hurt feelings, and choose wisely. Look for transparency and good communication. Consider supporting your small local mortgage brokers over national brand names.

Also keep in mind that the lowest interest rates don’t necessarily equate great customer service or more importantly – competence. There are plenty of horror stories out there to keep you up at night if you feel like googling.

For feedback, additional questions or a quick second opinion, feel free to email me at [email protected]. Or apply online to get started.