Zero, zilch, zip, nada, nothing. The idea that using a mortgage broker will cost extra is a myth.

Yes, there is always a cost. But except in certain circumstances, the mortgage broker fee is already included in the pricing of the interest rate you’re being offered.

Mortgage brokers have compensation agreements in place with wholesale lenders, and they get paid an agreed upon percentage of each loan closed. This amount is disclosed on your Closing Disclosure in the “paid by others” column.

There are two important things you should know about mortgage brokers, and the regulation they abide by:

- A mortgage broker cannot be compensated based on the terms of the transaction, only based on the transaction amount.

- Compensation can come from the lender OR from the borrower, but never from both.

In other words, a mortgage broker has no monetary incentive to place you in a higher interest rate, or a particular loan program. There is also no way to charge hidden fees, or “double dip” on a transaction, because the commission is already set.

Mortgage brokers save wholesale lenders the cost of direct to consumer advertising. In return, wholesale lenders pass on the savings by offering mortgage brokers access to lower interest rate pricing. How much lower? That depends on the particular wholesale lender. How much is the mortgage broker compensation? That will depend on the mortgage broker.

By comparison, here is how retail banking works, and how the setup affects you. This is based on my personal observations, deductive reasoning… and hearsay in the mortgage broker community.

When I talk about “retail”, I’m referring to: big banks, credit unions and direct lenders. Pretty much anyone that brags about having “in-house” underwriters will fit this category.

- Unlike mortgage brokers, retail banking is not required to disclose how much they benefit from a transaction. The profit margin is already included in your interest rate, but they also have the ability to charge an up front fee (origination charge). If you don’t shop, they don’t get caught.

- Layers upon layers of management and bonuses. Expensive big buildings and fat advertising budgets contribute to increased overhead costs, for which you guessed it – you end up paying. All while having the pleasure of going through a highly inefficient and bureaucratic process of obtaining a mortgage loan. Yay…

- The loan product offerings are limited. No one lender can do everything, so loans that don’t fit the predetermined “box” get turned away. Or worse, crammed into whatever loan product fits, even when it’s not cost effective or in the borrower’s best interest. As my USDA rural loan borrower from earlier this year found out when she found herself squeezed into a more expensive FHA loan by a local Utah bank.

Yes, I’m pointing out that the retail mortgage business model is overpriced, outdated, and not in your best interest. Mortgage brokers are gaining increased market share and for good reason – the mortgage broker business model is cheaper, more efficient, and ultimately benefits the consumer more.

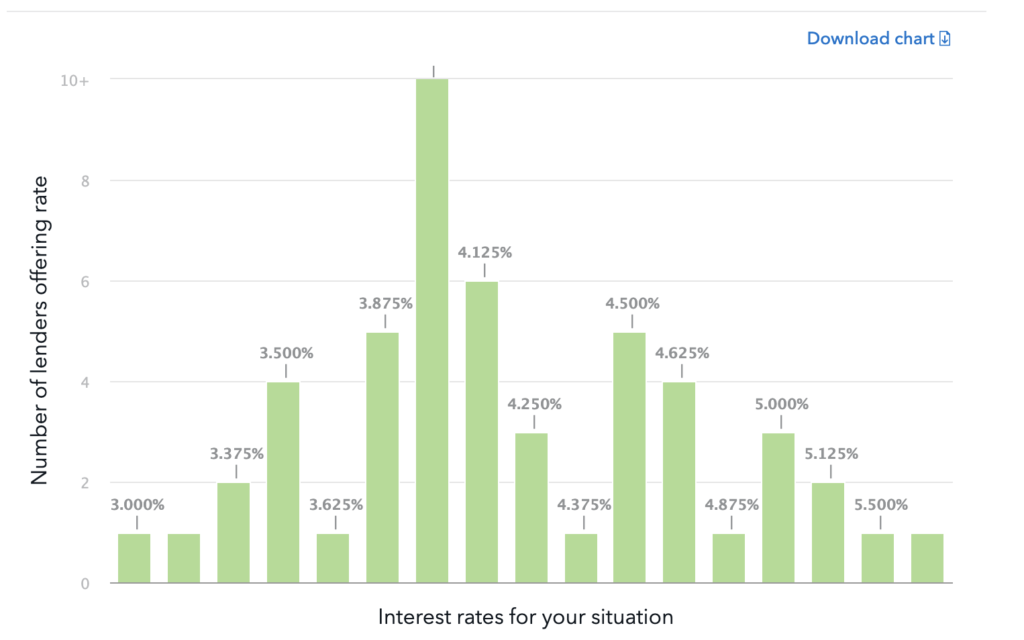

Interestingly enough, the CFPB (Consumer Financial Protection Bureau) has a little known tool for comparing interest rates offered on particular scenarios in each state. Here is how their chart looks like on a 680 to 699 credit score VA purchase loan at $300,000 with no down payment, on a 30 year fixed mortgage (as of 12-31-19):

How is it that some borrowers are able to get a rate as low as 3%, while others pay as high as 5.5%…? The discrepancy is ridiculous. Don’t be the borrower on the far right that got stuck with the 5.5% interest rate.

Now that you understand more about how business models affect the pricing of your loan, there is one more topic I want to touch upon. The topic of competency.

For some, mortgage brokers still seem to have a reputation of being the “middle man”.

In a sense they are, but not in the way of finding a client, “selling” the client and then simply collecting a finder’s fee.

Finding a client (you) is only the very first step. This action alone replaces thousands of dollars in old school advertising costs that a lender would otherwise have to incur. Your mortgage broker loan officer will then actually work on, and originate your loan. They’ll analyze your file, see if it meets the current guidelines or if an exception is needed, anticipate potential issues and match you with the best lender for your loan scenario. They will coach you, and advocate for you because that is where their loyalty (and paycheck) lies. Not with a particular lender’s underwriting department.

Mortgage brokers are required to have more expertise because they work with multiple investors, loan products and guidelines. They’re out there earning referrals and building a reputation. Answering phone calls and text messages and emails over the weekend. Saving deals other loan officers can’t or don’t know how to get done.

The true professionals in this business don’t clock in an out – they constantly check in.

You knew this was coming.

The real question isn’t how much will using a mortgage broker cost you. The real question is, can you afford not to use one? Reach out to me for a detailed quote at [email protected], or jump to my article detailing what you need to ask when shopping around.